JPMorgan’s recent forecast that Bitcoin (BTC) could soar to about $170,000 in the next year has grabbed headlines. In this article we break down that prediction, explain why big banks compare Bitcoin to gold, and answer common questions like whether you can buy Bitcoin for ₹100 and who holds most of the supply. You’ll learn the background, key factors, plus tips and FAQs – all in simple, beginner-friendly terms.

What Is Bitcoin?

Bitcoin is a decentralized digital currency running on a technology called blockchain. Unlike dollars or euros, no single government or bank controls Bitcoin. Think of it like digital gold – you can send and receive it peer-to-peer online. It was created in 2008 by the mysterious Satoshi Nakamoto and has since become the world’s most famous cryptocurrency. Each Bitcoin can be split into 100 million “satoshis,” so you don’t need to buy a whole coin at once.

Why It Matters: Bitcoin’s price often reflects broader financial trends. Big financial firms like JPMorgan track Bitcoin closely, because it’s seen by some as a store of value (like digital gold) and by others as a high-risk asset. Understanding their predictions can help investors make informed decisions.

JPMorgan’s Bitcoin Price Prediction

JPMorgan’s analysts, led by Nikolaos Panigirtzoglou, say their model which compares Bitcoin’s volatility to gold’s implies Bitcoin could reach roughly $170,000 over the next 6–12 months. In other words, if Bitcoin behaved like gold in recent years (adjusting for riskiness), it suggests an 84% upside from current levels.

- Key Forecast: The bank’s note highlights that Bitcoin’s volatility-adjusted comparison to gold implies a price near $170K. This assumes continued investor interest and that digital currency trades similarly to precious metals.

- Current Context: Bitcoin’s price peaked around $126,000 in early October 2025. As of late 2025, it’s nearer to $89,000–$93,000, down about 26% from the high. JPMorgan believes this drop might reverse if the gold-like trends hold.

- Rationale: JPMorgan has noticed that during stock market stress (like trade tariff fears in 2025), Bitcoin has sometimes risen alongside gold. Their metric adjusts for Bitcoin’s swings and still sees significant room to climb.

Factors Behind JPMorgan’s Forecast

JPMorgan also points to a few specific factors that could influence Bitcoin:

- Bitcoin as “Digital Gold”: The strategy assumes Bitcoin increasingly acts like a precious metal safe-haven. If investors see it as a store of value, similar to gold, price rises could follow similar patterns.

- MicroStrategy’s Holdings: MicroStrategy (ticker MSTR), led by Michael Saylor, is the largest corporate holder of Bitcoin. It owns ~437,000 BTC (as of Nov 2025). JPMorgan notes that if MicroStrategy holds its coins, that’s bullish. Conversely, if it were forced to sell, that could pressure prices. (However, the firm has built up large cash reserves to weather price dips, making forced selling “even less likely”.)

- Regulatory and Market Events: Like all crypto forecasts, things like interest rates, regulations, and big events can sway prices. For example, JPMorgan and others watch whether index providers include crypto (which can boost demand) or how global central bank policies affect risk assets.

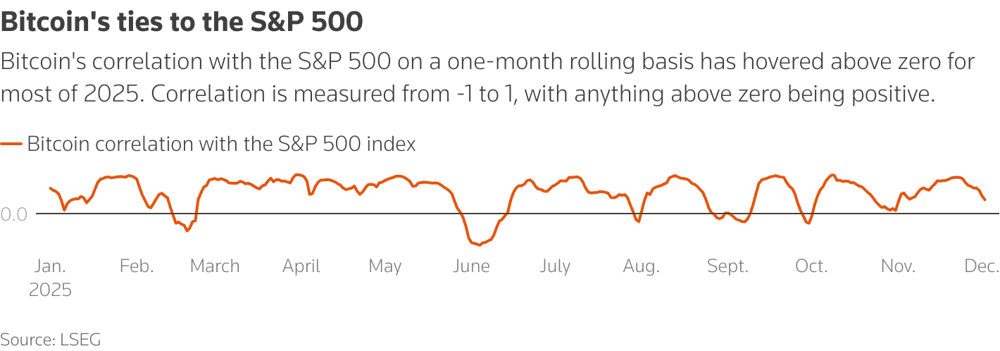

Bitcoin’s one-month rolling correlation with the S&P 500 in 2025. In 2025, the average Bitcoin S&P correlation was ~0.5 (versus 0.29 in 2024), indicating crypto moved more in tandem with stocks.

Why Bitcoin vs. Gold?

To understand JPMorgan’s logic, it helps to see Bitcoin vs Gold:

- Supply: Gold supply grows slowly with mining; Bitcoin supply is capped at 21 million coins. New bitcoins are created by “mining” and the rate halves every 4 years, making it deflationary over time.

- Store of Value: Gold has centuries as a value for centuries. Bitcoin’s backers call it “digital gold” because, like gold, it isn’t controlled by any country and can hedge against inflation. JPMorgan’s analysis literally treats Bitcoin’s price trends in light of gold’s behavior.

- Performance 2025: Both had record runs. Gold hit about $4,381/oz in 2025. Bitcoin peaked around $126,000. Both have since cooled; JPMorgan forecasts both higher (gold to ~$5,055/oz by late 2026, Bitcoin to ~$170K).

- Correlation: Interestingly, 2025 saw Bitcoin move more with stocks and global markets, unlike earlier years. Gold often moves opposite the stock market, but crypto’s link to tech/AI bubbles (and U.S. politics) has aligned it more with risk assets.

The table below highlights some comparisons:

| Asset | 2025 Peak Price | JPMorgan Forecast | Key Drivers |

|---|---|---|---|

| Bitcoin | ~$126,000 (Oct 2025) | ~$170,000 (within 6–12 months) | Model assumes gold-like demand and rising adoption |

| Gold | ~$4,381/oz(Aug 2025) | ~$5,055/oz (by late 2026) | Fed rate cuts, high inflation hedge |

This shows that JPMorgan sees potential upside in both – but remember, forecasts are not certainties.

Can I Buy Bitcoin for ₹100?

Yes! Bitcoin is highly divisible, so you don’t need thousands of rupees to own a fraction. One bitcoin = 100 million satoshis. Exchanges in India (like WazirX, CoinDCX, etc.) allow buying very small amounts (even ₹100 or ₹500). For example, if 1 BTC = ₹7,500,000, then ₹100 would buy about 0.000013 BTC (1.3e-5 BTC). Essentially, ₹100–₹500 can get you some satoshis on most crypto platforms.

How to buy:

- Choose a reputable crypto exchange that supports INR (e.g. WazirX, CoinDCX).

- Complete verification (KYC) with ID proof.

- Deposit funds via bank transfer or UPI.

- Place a buy order for Bitcoin (BTC). Enter the INR amount (even ₹100) to see how many BTC you get.

- After purchase, move your coins to a secure wallet (like a hardware wallet or trusted mobile wallet) for safety.

So even with ₹100, you can start investing in Bitcoin easily, it is one reason many view crypto as very accessible.

Who Owns 90% of Bitcoins?

It’s often said that a tiny group controls most Bitcoin. On-chain analyses estimate the top 1–2% of Bitcoin addresses hold roughly 90% of the supply. These are likely “whales”: early adopters, major crypto funds, or companies like MicroStrategy and Tesla. In short, wealth distribution is very uneven. For a novice, very few wallets control the bulk of Bitcoin. That’s why big holders (whales) can sometimes sway the price by their trades.

Key point: Don’t worry that a single person “owns 90%.” Bitcoin’s code doesn’t give any owner special power. But it does mean markets are sensitive to a few big players’ actions.

Benefits of Bitcoin Investment

- High Upside Potential: Bitcoin has grown dramatically over the past decade, sometimes rewarding investors 5x–10x. Analysts like JPMorgan believe more gains could come if adoption rises.

- Decentralization: Unlike bank-controlled currencies, Bitcoin is run by code and global nodes, not any government. This appeals to people who want an alternative money system.

- Hedge Against Inflation: With a hard cap of 21M coins, Bitcoin is immune to central banks “printing” extra money. Many see it as protection if fiat currencies lose value.

- Fractional Buying: You can invest any amount (₹100 or $1). This makes it easy for beginners to start small and scale up.

- Growing Acceptance: Increasingly, companies and even some countries accept or hold Bitcoin. More usage can support the price.

- 24/7 Market: Crypto markets never sleep. This constant activity can be an opportunity (though also a risk of 24/7 volatility).

Risks and Drawbacks

- Volatility: Bitcoin’s price swings are extreme. In 2025, it fell ~26% from its peak. Losses can be steep in a downturn.

- Speculative Nature: Much of Bitcoin’s value is based on belief and speculation. If confidence drops, prices can plunge quickly.

- Regulatory Uncertainty: Governments worldwide are still figuring out crypto rules. New regulations (like bans or taxes) can hit prices.

- Security Risks: While Bitcoin’s blockchain is secure, exchanges and wallets can be hacked. Always use best practices (two-factor auth, cold storage).

- Lack of Consumer Protections: Unlike banks or stock markets, Bitcoin investments have limited recourse if something goes wrong.

- Environmental Concerns: Bitcoin mining consumes lots of electricity. This has led to criticism and the potential for future regulation.

- Market Correlation: As noted, Bitcoin in 2025 often moved with stock markets. In a broader market crash, Bitcoin may fall too.

Key Insights and Best Practices

- Don’t Rely on One Prediction: JPMorgan’s $170K target is one scenario. Other experts have different forecasts (some higher, some lower). Use forecasts as data points, not guarantees.

- Understand Volatility: Be mentally prepared for big swings. Only invest money you won’t need for emergencies.

- Diversify: Consider Bitcoin as part of a broader portfolio. You might also hold stocks, bonds, or commodities like gold to spread risk.

- Stay Updated: Crypto markets change fast. Follow reliable news or analysis (JPMorgan, blockchain reports, etc.) but watch out for hype.

- Safety First: Always keep your crypto secure in reputable wallets or exchanges. Use hardware wallets for large holdings.

- Regulations Matter: Especially if you buy crypto in India. Follow local tax laws and guidelines when investing in Bitcoin.

Common Questions

Q: What exactly did JPMorgan predict about Bitcoin’s price?

A: JPMorgan’s analysts said that, if Bitcoin follows trends like gold, its risk-adjusted price could hit about $170,000 in the next 6–12 months. This is an optimistic forecast based on a model linking Bitcoin to gold’s price moves, and assumes key conditions like continued adoption and no major negative shocks.

Q: Why compare Bitcoin to gold?

A: Both Bitcoin and gold are viewed as stores of value. Gold has a long history of protecting wealth, especially when inflation is high. Bitcoin is called “digital gold” because of its limited supply and potential inflation hedge. JPMorgan uses this analogy: if investors treat Bitcoin like gold, the math suggests a much higher Bitcoin price.

Q: Can I really buy Bitcoin with just ₹100?

A: Yes! You can buy fractional Bitcoin. One bitcoin = 100 million satoshis, so even ₹100 (roughly $1–2) will buy a tiny fraction of a BTC. Indian exchanges like WazirX or CoinDCX allow purchases starting at very low amounts. Just make an account, deposit money, and buy the desired INR worth of Bitcoin.

Q: Who really owns 90% of all bitcoins?

A: It’s estimated that roughly 1–2% of Bitcoin holders (whales and large firms) control about 90% of all BTC. These include crypto investment funds, early adopters, and big companies like MicroStrategy. This means most people hold very little Bitcoin individually, a few major holders own the bulk.

Q: How does JPMorgan’s $170K forecast compare to other predictions?

A: It’s in the range of other bullish calls. For example, Standard Chartered once predicted ~$200,000 by end of 2025, and MicroStrategy’s CEO Saylor has spoken of $150K targets. But note: JPMorgan’s model is unique (volatility-adjusted vs gold). Predictions vary widely, so it’s wise to consider multiple viewpoints.

Q: Should I trust Bitcoin price predictions?

A: Use them as guidance, not gospel. Forecasts reflect one analysis or model under certain assumptions. They can be wrong if conditions change. It’s best to do your own research and not invest solely because of a prediction.

Q: How do I safely buy and hold Bitcoin in India?

A: Choose a regulated Indian crypto exchange (like WazirX, CoinDCX, or others). Verify your ID, deposit INR via bank/UPI, and buy BTC. Then move your coins to a secure wallet – hardware wallets (like Ledger or Trezor) are safest for large amounts. Always enable strong passwords and 2FA.

Q: What factors most influence Bitcoin’s price?

A: Many factors: institutional adoption (more big investors buying in), regulatory news (bans or acceptance), macroeconomics (inflation, interest rates), and market sentiment (crypto mania or fear). Even events like new Bitcoin ETF approvals or big holders selling can move the price.

Practical Tips for Crypto Investors

- Tip 1: Do Your Homework. Understand what Bitcoin is and how crypto markets work. Read multiple analyses and avoid blind hype.

- Tip 2: Use Strong Security. After buying, store Bitcoin in a private wallet (not just on an exchange). Use two-factor authentication and keep backups of your keys.

- Tip 3: Start Small and Diversify. Don’t put all your savings into Bitcoin. It can be one part of a varied investment plan.

- Tip 4: Keep Emotions in Check. Bitcoin can skyrocket or crash quickly. Make plans (buy, hold, sell rules) before big moves happen.

- Tip 5: Stay Informed. Follow reputable finance and crypto news (for example, JPMorgan reports, trusted news sites) to track factors like government regulation or technical updates.

Conclusion

JPMorgan’s forecast of Bitcoin reaching ~$170,000 is certainly bold, highlighting growing institutional interest in crypto. It’s based on a model linking Bitcoin to gold and assumes strong demand ahead. However, Bitcoin remains volatile and influenced by many unpredictable factors (regulation, big investor actions, market sentiment).

For beginners, the takeaway is to be informed and cautious. Learn the basics (how Bitcoin works, what satoshis are), diversify your investments, and never chase 100% guaranteed returns from any prediction. Whether or not Bitcoin hits $170K, JPMorgan’s outlook signals one thing: major financial players see Bitcoin as a serious asset. As you invest, remember the golden rule: never invest more than you can afford to lose.