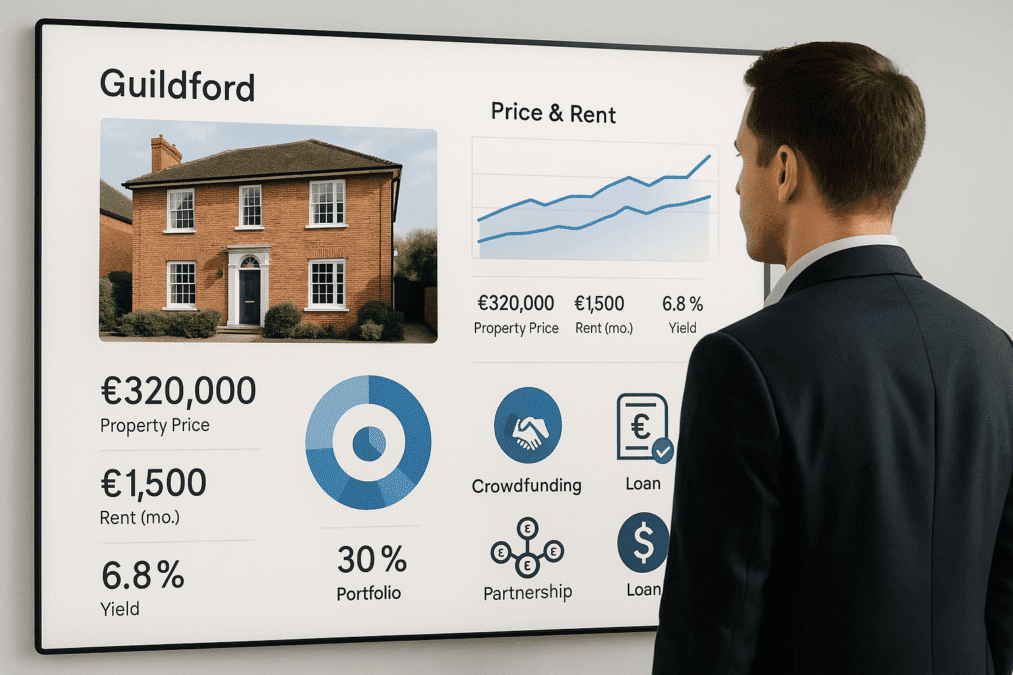

Property investment in Guildford has always been an attractive prospect, thanks to its strong rental demand, excellent transport links to London, and reputation as a thriving university town. However, with rising property prices and stricter lending criteria from traditional banks, many investors are now seeking alternative financing options to expand their portfolios or step into the market for the first time.

In this article, we’ll explore the key financing methods available in Guildford beyond conventional mortgages, helping investors make smarter and more flexible decisions.

Why Guildford Is a Hotspot for Property Investment in Guildford

Guildford has consistently ranked as one of the most desirable commuter towns in Surrey. Its proximity to London, high-quality schools, and vibrant town centre make it a preferred location for families, professionals, and students. This naturally increases demand for rental properties, from single-family homes to student accommodations, making Property Investment in Guildford a highly attractive opportunity.

However, with average property prices in Guildford often exceeding £500,000 (Rightmove), traditional mortgage financing can be challenging. That’s why alternative property financing options are becoming more appealing.

1. Bridging Loans

One of the most popular alternative financing solutions is a bridging loan. These short-term loans are ideal for investors looking to:

- Secure a property quickly before selling another.

- Buy properties at auctions.

- Fund renovation projects before refinancing.

While interest rates on bridging loans are typically higher than standard mortgages, their flexibility and speed make them invaluable for competitive markets like Guildford.

2. Joint Ventures and Partnerships

For investors struggling to raise capital alone, joint ventures (JVs) offer a smart route. By partnering with another investor or a developer, you can share both the risks and rewards. This approach can make Property Investment in Guildford more accessible, especially for those who might otherwise find it financially out of reach.

For example:

- One partner provides the capital.

- The other manages the property development or rental operations.

This collaborative approach allows you to access properties in Guildford that might otherwise be out of reach.

3. Crowdfunding Platforms

Property crowdfunding is an innovative financing method where multiple investors pool funds together to buy a property. Platforms such as Property Partner allow individuals to invest smaller amounts and still benefit from rental yields and capital appreciation.

This is especially attractive for new investors who want exposure to the Guildford market without committing to a full property purchase.

4. Private Lenders and Peer-to-Peer Loans

Private lenders and peer-to-peer (P2P) lending platforms provide another alternative. These options usually:

- Offer more flexible lending terms than banks.

- Are faster to arrange.

- May require higher interest payments.

For investors in Guildford, P2P loans can be particularly useful when a traditional mortgage isn’t feasible due to credit history, income structure, or the property type.

5. Self-Invested Personal Pension (SIPP)

For long-term investors, using a SIPP (Self-Invested Personal Pension) can be a strategic way to finance property purchases, especially for commercial investments. While residential properties are generally excluded from SIPP, buying commercial property in Guildford (such as office space or retail units) through a pension plan can provide both tax advantages and future growth opportunities.

6. Rent-to-Rent Strategy

Although not a direct financing option, the rent-to-rent model is gaining traction among property entrepreneurs. This involves leasing a property from a landlord, then subletting it (with permission) at a higher rate, often by converting it into an HMO (House in Multiple Occupation). For those exploring Property Investment in Guildford, this strategy can deliver strong rental yields without requiring heavy upfront capital.

For Guildford, with its large student population, this strategy can deliver strong rental yields without the need for heavy upfront capital.

Final Thoughts

Exploring alternative financing options for Property Investment in Guildford opens the door to new opportunities for both seasoned investors and newcomers. Whether through bridging loans, crowdfunding, joint ventures, or creative strategies like rent-to-rent, investors can find flexible solutions tailored to their goals.

Before committing, it’s essential to seek financial advice and weigh the risks against potential rewards. With Guildford’s growing demand and strong fundamentals, the right financing strategy for Property Investment in Guildford can unlock long-term profitability.

For more insights into property investment strategies, you can explore resources like Guildford Borough Council’s housing market reports to stay updated.