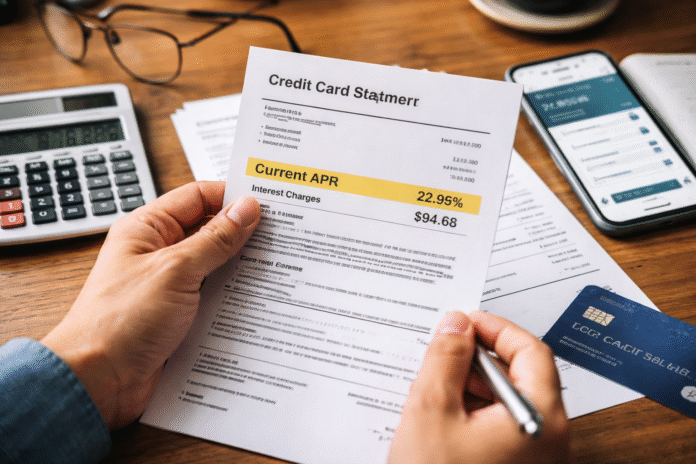

Borrowers on both sides of the Atlantic have been asking the same question in a higher-rate world: how to lower interest rate on credit card without changing their day-to-day spending. Credit card APRs often feel stubborn, even when central banks pause or signal future cuts. That matters because credit cards are usually among the most expensive mainstream forms of consumer borrowing, and interest can compound quickly when balances are carried month to month.

The short answer is that card pricing is typically built from moving parts benchmark rates set by central banks, lender funding costs, and borrower risk so the path to a lower APR can look more like a negotiation than a simple request. In online discussions, some consumers describe getting reductions after calling issuers, citing competing offers, or demonstrating a track record of payments though outcomes can vary widely by lender, market, and credit profile. One such thread discussing negotiation tactics and what people said worked is captured in this interest-rate discussion on Reddit.

In the US and UK, this is happening against a backdrop of elevated policy rates compared with the pre-pandemic era. The Federal Reserve and the Bank of England do not set credit card APRs directly, but their decisions influence the base rates lenders reference, and that tends to flow into variable-rate card pricing over time. When those base rates rise, APRs often lift. When they fall, some borrowers expect rapid relief, but issuers may adjust at different speeds, and risk-based pricing can keep rates high for people lenders view as higher risk.

Rates stay high, and households notice

Credit card APRs can look confusing because many products advertise a range, not a single price, and some customers are offered different terms than others. In the US, variable APRs are often expressed as a base rate plus a margin, and the “base” is frequently tied to a widely used reference such as the prime rate. In the UK, cards also advertise representative APRs and may apply different purchase rates depending on underwriting. That structure helps explain why a friend’s account might change while another person’s does not.

Borrowers often search for simple benchmarks what is a good apr credit card rate but “good” depends on timing and on the individual’s credit profile. When central bank rates are low, a “good” variable APR may also be lower. When policy rates are higher, the entire market can shift upward. Analysts who track consumer credit often describe credit cards as a category where lenders price in both the cost of funds and the probability of non-payment, with extra room for uncertainty when economic conditions look shaky.

That uncertainty can be visible in how lenders manage accounts. Issuers may tighten approvals, reduce credit limits for some customers, or keep pricing conservative even when competition exists. They can also offer promotional rates to attract new balances, while leaving standard purchase APRs elevated. The result is that many consumers see plenty of marketing but less movement on the rate they already pay.

Still, some borrowers do manage to lower interest rate on credit card accounts, most commonly by showing stronger credit risk signals or by moving balances to new terms. The key is understanding what issuers typically care about: payment history, utilization (how much of available credit is being used), income and employment stability, and the broader environment for funding and defaults.

For readers who want the credit-score angle in a UK context, BlinkFeed has a related explainer on improving your UK score using a credit card, including how lenders may interpret utilization and consistency.

How lenders decide whether an APR can change

From a lender’s perspective, a credit card APR is not only a price; it is also a risk buffer. Credit card debt is typically unsecured—there is no house or car pledged as collateral so if a borrower defaults, recoveries can be limited. That is one reason card APRs tend to sit above secured loans and above many personal loans.

When a borrower asks for a lower APR, issuers may check internal and external data. Internal data can include how long the account has been open, whether payments arrive on time, whether there were recent late fees, and whether spending patterns have shifted. External data can include credit bureau information: overall utilization, recent new credit applications, and the presence of delinquency or collections elsewhere.

This is why the same request can produce different answers. A customer who has consistently paid on time and reduced balances may appear less risky than someone whose balance has grown or who recently missed a payment. Even then, the outcome may depend on the issuer’s policies and current appetite for risk. Banks can also run retention strategies: if a customer signals they might leave for another product, some issuers may respond with a targeted offer. Others may not.

In practice, a borrower seeking to lower an APR often ends up in one of three channels:

First, a direct APR review or retention offer. Some issuers are willing to review the rate upon request, sometimes after verifying income or assessing credit.

Second, a product change within the same issuer. A bank might allow a customer to switch to a different card type with different pricing, although that can come with trade-offs such as different rewards or fees.

Third, a balance transfer or refinancing to a new lender or product. This can change the cost of existing debt, at least for a promotional window, but it can involve fees and eligibility checks. In a newsroom-style frame, it is less “one trick” and more a set of options with conditions.

Search behaviour reflects that complexity. People type broad questions like “APR too high” alongside very specific terms tied to particular products or marketing lines, such as usaa rate advantage credit card. Product names can become shorthand for “lower-rate credit card,” but actual terms depend on underwriting, membership eligibility where applicable, and account features that can change over time. A branded search term is not a guarantee of a specific rate.

The cap debate and what it could mean

The phrase credit card interest rate cap surfaces regularly when borrowing costs climb. Policymakers in several countries periodically debate whether legal limits should apply to consumer credit rates, especially when households are under stress. The logic is straightforward: if a cap is imposed, some borrowers would pay less interest on balances they carry.

But the implications can be complicated. A cap could reduce costs for people who still qualify for cards under the new rules, while also leading lenders to tighten access, cut limits, or shift consumers toward other products. Analysts often note that when a price ceiling is introduced in any market, providers may respond by changing who they serve or what they offer, especially in risk-heavy segments.

In the US, interest rate policy and consumer credit regulation sit across multiple institutions and legal frameworks, which can shape how any cap proposal is designed or debated. In the UK, consumer credit rules are overseen through a different regulatory structure, with separate approaches to affordability and product governance. The EU has its own patchwork of national rules within broader consumer protection standards. For global readers, the key point is that “cap” discussions are usually political and legal questions as much as financial ones, and outcomes tend to take time if they happen at all.

For now, most borrowers operate in the world as it is: rates that follow broad benchmarks upward, and that may drift downward unevenly if and when policy rates fall. That leaves households focusing on practical levers that influence the rate they are offered: credit risk signals, competition between lenders, and account behaviour over time.

What may matter most for consumers right now

For borrowers carrying balances, the most immediate driver of cost is the APR applied to the amount not paid off each month. Even a small change can alter how quickly interest accumulates, although the real-world impact depends on balance size and payment patterns.

In the US and UK alike, consumer advocates and many financial educators emphasize the difference between paying in full and revolving a balance. Paying in full avoids interest on purchases for most cards, but many households do not have that flexibility every month. When balances roll over, the rate matters much more.

That is where “lowering the APR” becomes a practical question rather than a theoretical one. Issuers may be more willing to adjust terms when they believe the customer will remain profitable and lower risk. Consumers sometimes mention factors like improved credit scores, lower utilization, or a steady payment record when reporting a successful request. Other borrowers report being denied, especially after recent late payments or when macroeconomic conditions push lenders to be cautious.

In a market context, there is also a timing element. If benchmark rates are stable or falling, some variable APRs may ease gradually, while fixed-rate offers in marketing may become more competitive. If rates are rising or recession fears increase expected defaults, lenders may keep pricing tight. The direction of travel in central bank policy can shape the competitive landscape, even if it does not determine any one person’s APR.

For borrowers weighing options, it can help to separate two questions: “Can my existing issuer reduce my rate?” and “Is there another product that would price my risk lower?” The first depends heavily on the issuer’s willingness and on account history. The second depends on eligibility and the market.

Below is a simple comparison table to frame what tends to move the needle, without assuming any guaranteed outcome.

| Route to a lower APR | What it is | Why it might matter | What to watch |

|---|---|---|---|

| Issuer APR review / retention offer | Asking the current lender to reassess pricing | Issuer may adjust if risk looks lower or if it wants to keep the account | Outcome varies; may require income verification or credit review |

| Product change within same bank | Switching to another card product offered by the issuer | Different products can carry different pricing structures | Terms, fees, rewards, and eligibility can differ |

| Balance transfer to a new offer | Moving an existing balance to a different card, sometimes with a promotional rate | Can reduce interest cost for a set period if approved | Transfer fees, promo end date, reversion APR, and credit checks |

| Personal loan refinancing (market-dependent) | Replacing revolving debt with an instalment loan | Instalment loans can be priced differently and provide a fixed payoff schedule | Approval, total cost including fees, and repayment discipline |

| Improving credit profile over time | Strengthening factors lenders use to price risk | Lower risk signals can lead to better offers and terms | Takes time; lenders’ criteria and macro conditions can change |

For UK readers, credit scoring systems differ from the US, and so do some credit card pricing norms. Still, the same broad logic often holds: the less risky a borrower appears, the more likely a lender is to offer a lower rate though no single factor controls the decision.

What to watch next

Looking ahead, the biggest swing factor is the direction of central bank policy and the broader economy. If inflation cools and policymakers cut rates, base rates that influence variable APRs may fall over time. If the economy weakens and credit losses rise, lenders may still keep margins wide, especially for higher-risk segments.

Regulatory attention is another variable. Consumer credit often becomes a focus when borrowing stress rises, and public debate around fairness, transparency, and affordability can intensify. That includes periodic talk of a credit card interest rate cap, as well as scrutiny of fees and marketing practices. Any concrete policy shift, though, typically involves consultation periods, legislative steps, and implementation timelines.

For consumers, the practical takeaway is that credit card APRs are not purely a “market price” like a stock quote. They are set by lenders using both external benchmarks and individual risk assessments. That is why the experience of trying to reduce a rate can feel unpredictable and why two people can ask the same question and get different answers.

In that environment, readers searching how to lower interest rate on credit card may find it helpful to think like a lender for a moment: what would make this account look safer or more attractive to keep? Sometimes that is a stronger payment record, sometimes it is a competitive offer elsewhere, and sometimes it is simply time and improved credit metrics. None of those guarantees an APR cut, but they explain why some attempts succeed and others stall.

Table

| Route to a lower APR | What it is | Why it might matter | What to watch |

|---|---|---|---|

| Issuer APR review / retention offer | Asking the current lender to reassess pricing | Issuer may adjust if risk looks lower or if it wants to keep the account | Outcome varies; may require income verification or credit review |

| Product change within same bank | Switching to another card product offered by the issuer | Different products can carry different pricing structures | Terms, fees, rewards, and eligibility can differ |

| Balance transfer to a new offer | Moving an existing balance to a different card, sometimes with a promotional rate | Can reduce interest cost for a set period if approved | Transfer fees, promo end date, reversion APR, and credit checks |

| Personal loan refinancing (market-dependent) | Replacing revolving debt with an instalment loan | Instalment loans can be priced differently and provide a fixed payoff schedule | Approval, total cost including fees, and repayment discipline |

| Improving credit profile over time | Strengthening factors lenders use to price risk | Lower risk signals can lead to better offers and terms | Takes time; lenders’ criteria and macro conditions can change |

FAQ

Q1: What is a good apr credit card rate right now?

A “good” APR is relative to the market and to a borrower’s credit profile. When policy rates are higher, average card APRs across the market tend to be higher too, and individual offers can vary widely based on risk.

Q2: Can a lender lower interest rate on credit card accounts without changing the product?

Some issuers can adjust APRs on existing accounts, often after an internal review. Others may prefer offering different products or promotional balance transfer terms rather than changing a standard purchase APR.

Q3: Is a credit card interest rate cap likely to reduce costs for everyone?

A cap could lower rates for accounts that remain available under the new rules, but it could also lead lenders to tighten approvals, reduce limits, or shift product terms. The net effect depends on how any cap is designed and enforced.

Q4: Why do branded searches like “usaa rate advantage credit card” show up in APR research?

Borrowers often search product names when looking for lower-rate options or specific eligibility categories. However, branded terms are not a guarantee of a particular APR; final pricing usually depends on underwriting and current terms.

Q5: Do UK and US credit cards price APRs the same way?

Not exactly. The US commonly uses variable APRs tied to reference rates plus a margin, while the UK often uses representative APR advertising with pricing that can still be risk-based. In both markets, borrower risk and base-rate conditions can influence what a person pays.

Conclusion

Lowering a credit card APR is rarely automatic. Rates reflect a mix of central bank policy, lender risk models, and individual account history, which means changes often arrive unevenly or not at all. While some borrowers do see reductions through reviews, product changes, or competitive pressure others may find pricing stays firm even as broader rates shift. For readers asking how to lower interest rate on credit card balances, the key takeaway is that outcomes depend on timing, credit risk signals, and lender strategy, not a single rule or guarantee.