People & Celebrities — Tech & Companies — Brands & Platforms — Queries & Fun Keywords — News & Crypto

BlackRock, character ai, ai image generators, tesla, microsoft, amazon job, ipads, tiktok, tiktok shop, techcrunch, jack dorsey, tsla stock price, marc andreessen, robot, google gemini, indeed, bluesky, nasdaq:tsla, ripple in the news, salesforce, internet archive wayback, wayback machine site, discord, gamestop, the huffington post, pradas, oakley, uber rides, google plus, google play store app, apple music replay, solitaire google game, do a barrel roll, doodle for google baseball, crypto30x.com news

Understanding BlackRock: A Deep Dive

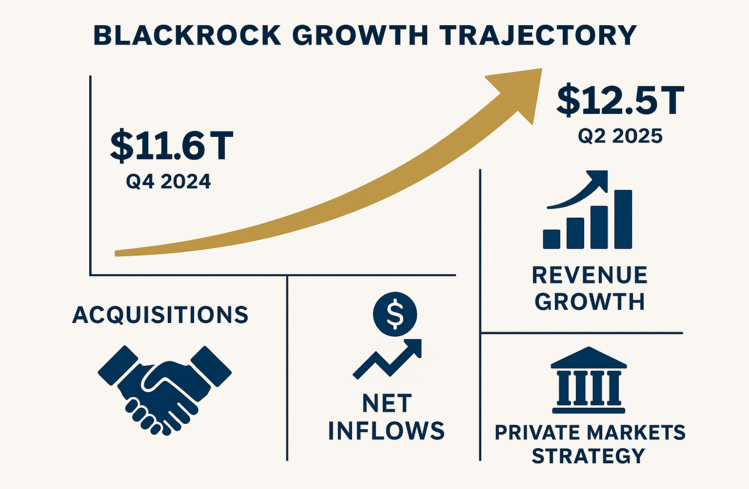

BlackRock, Inc. is the world’s largest asset management firm, headquartered in New York. As of the second quarter of 2025, it manages a staggering $12.5 trillion in assets under management (AUM), a record high driven by acquisitions and market gains WikipediaFN LondonBusiness Insider.

AUM Growth & Milestones

- In Q4 2024, BlackRock reported $11.6 trillion AUM, thanks to buoyant markets and strong net inflows ReutersBlackRock.

- By Q2 2025, AUM surged to $12.5 trillion, with significant contributions from acquisitions like HPS Investment Partners and Global Infrastructure Partners (GIP) FN LondonReutersWikipedia.

Financial Highlights

- In Q2 2025, net inflows were $68 billion, though slightly below expectations due to a $52 billion withdrawal by a major Asian institutional client Financial Times.

- Revenue rose by 13%, and net income increased by 7%, bolstered by diversified earnings streams—including technology services and private market fund fees Financial TimesFN LondonBusiness Insider.

Strategic Shift into Private Markets

- BlackRock is aggressively expanding its private markets presence, aiming to raise $400 billion by 2030 and derive 30% of its revenue from private market funds and tech services such as its Aladdin platform Business InsiderFN London.

- CEO Larry Fink continues to steer the firm through a series of high-profile acquisitions to bolster its infrastructure and private credit capabilities ReutersFN London.

ESG Backlash & Regulatory Landscape

- BlackRock has recently scaled back some ESG commitments, leading to its removal from Texas’s investment blacklist and easing tensions with state regulators—though it still faces legal scrutiny over ESG-related antitrust concerns New York Post.

Why BlackRock Matters

BlackRock isn’t just a fund manager—it is a global financial powerhouse, deeply embedded in public markets through iShares ETFs, influential in private asset growth, and increasingly pivotal in shaping global investment infrastructure via its tech platform, Aladdin.